Plugged In @ Hinman Straub

February 6, 2023

What’s Inside

- Governor Releases Executive Budget

- Governor Vetoes Last Two Bills of 2022

- Governor Announces Round XII Awards of the Regional Economic Development Council Initiative

- Comptroller Calls for State Debt Reform Citing Projected $26 Billion Increase Over Next Five Years

- Former State Senator to Run for Dutchess County Executive

- Political Updates

- Coming Up

Governor Releases Executive Budget

The Governor delivered her Executive Budget address on Wednesday, February 1, 2023, at the State Capitol in Albany. Her budget proposal totals $227 billion, a $5.4 billion increase (2.4%) over FY 2022-23. She reiterated her recent pledge not to raise income taxes this year.

Tax receipts have surged in recent months, resulting in a General Fund surplus of approximately $8.7 billion. More than half of the surplus will be used to accelerate deposits to “rainy day” reserves planned for FY 2024 ($2.4 billion) and FY 2025 ($2.9 billion).

The Governor’s budget proposal includes initiatives unveiled in her State of the State address on January 10. The Executive Budget includes major initiatives in mental health, affordable housing and public safety. Highlights of the 2024 Executive Budget proposal include the following:

Mental Health

A key initiative within the Governor’s budget proposal is to significantly bolster mental health care. She will seek $1 billion for a multi-year program impacting a wide array of mental health services, including:

- $915 million to develop new mental health residential units, and $127 million for annual operating costs.

- $18 million in capital and $30 million annually to increase operational capacity for inpatient psychiatric treatment.

- $60 million in capital and $122 million annually to expand outpatient services.

- $27.5 million annually to improve post-discharge connections to services.

- $30 million annually to expand mental health services in schools.

Affordable Housing

Affordable housing is another major focus of the Executive Budget. The Governor announced the “New York Housing Compact” that aims to create 800,000 new homes over the next 10 years. This initiative intends to confront rising home prices, rising rental rates, outmigration from the State, and the need for homeless housing by requiring localities to meet “home creation targets” on a three-year cycle. The plan would also provide alternative approval processes for projects that are not approved at the local level. The Executive Budget includes $250 million for infrastructure grants to support affordable housing. Developments in proximity to mass transit would be incentivized, and legislation will be submitted to expedite rezoning and the development of new homes.

Public Safety

The Governor will propose changes to the bail system to restore judicial discretion in certain serious cases. The Executive Budget also proposes $337 million – a $110 million increase – for programs to reduce gun violence. The budget would also double current funding to police departments in 17 counties that account for more than 80 percent of the violent crime in the State ($36.4 million) and would increase funding for parole supervision and post-incarceration reentry services.

Child Care

The Executive Budget proposes measures to make child care more affordable and accessible. The new budget would raise the income limit for childcare assistance, incentivize employers to create employer supported childcare programs, and standardize eligibility for child care assistance.

Environment

New York has enacted aggressive targets to reduce greenhouse gas emissions in coming years. Toward meeting these goals, the Governor announced a new “cap-and-invest” program to curtail emissions and a new Climate Action Fund projected to raise $1 billion annually. New Yorkers approved a new $2 billion environmental bond issue last fall, in addition to which the Executive Budget proposes $500 million for clean water infrastructure, and $400 million for the Environmental Protection Fund. The Governor will also propose an “extended producer responsibility” program for paper and packaging products.

School Aid

The Governor proposes $34.5 billion in aid to public schools, the highest level in state history. This includes $24 billion for Foundation Aid – a $2.7 billion increase from last year – to complete the three-year phase-in to fully fund Foundation Aid. The budget proposal also includes a $125 million hike in aid to prekindergarten programs, to total $1.2 billion.

Minimum Wage

The Executive Budget proposes to automatically increase the minimum wage in alignment with the Consumer Price Index. Annual increases would be capped to ensure that no single-year increase would threaten employment. Increases could be paused during certain economic conditions.

Tobacco Taxes & Flavored Product Ban

The Executive Budget proposes to expand the State’s ban on the sale of flavored vaping products by prohibiting the sale of all flavored tobacco products. The budget proposal would also increase the cigarette tax from $4.35 to $5.35 per pack.

________________________________________

Under New York’s budget-making process, the Governor develops and proposes to the Legislature a comprehensive and balanced budget proposal – the FY 2024 Executive Budget proposal issued February 1. The Governor also has two opportunities to amend her budget, once on the 21st day after submission and again on the 30th day.

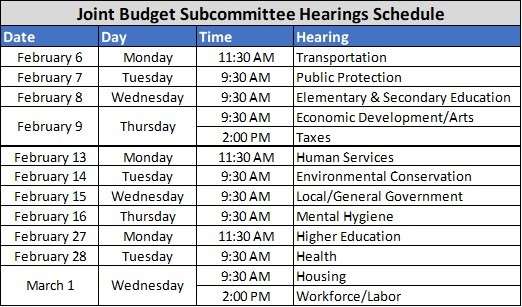

Over the next several weeks, the Assembly and Senate will conduct joint hearings on the proposal – by agency and issue area – and negotiations with the Governor usually commence thereafter. These hearings will begin on February 6.

The 2007 Budget Reform Act mandated the use of conference committees as part of the legislative budget process. These committees work to facilitate agreement on a budget plan between the two houses. The Assembly and Senate ultimately develop joint recommendations, amend the Governor’s proposed bills to reflect their priorities, and pass the amended bills.

Governor Vetoes Last Two Bills of 2022

The last two remaining bills of 2022 were vetoed by the Governor this week. Both bills were delivered without providing the Governor a full 10 days before the expiration of the Legislative term which would have allowed the Governor to Pocket Veto both bills. Instead, the Governor issued actual vetoes for both bills on the last day to act and sent them back to the Legislature without her approval.

S.8815 Krueger/A.9975 Weinstein – Relates to the liability of a person who presents false claims for money or property to the state or a local government

In 2013, the New York False Claims Act was amended to expand civil liability to persons who defraud the state or local governments by “knowingly concealing” or “knowingly and improperly” avoiding obligations to pay money to the State or a local government. This bill would have further expanded the False Claims Act by authorizing civil actions against individuals and businesses that knowingly conceal or knowingly and improperly avoid established tax obligations by not filing any tax returns at all.

The Governor objected to the bill on the grounds that it was overly broad and goes significantly beyond how the federal government and other states pursue civil tax fraud. The Governor also objected to the undefined retroactive lookback period contained in the bill because it fails to provide notice to filers and raises due process concerns.

S.74-A Hoylman/A.6770 Weinstein – Provides for the types of damages that may be awarded to the persons for whose benefit an action for wrongful death is brought

The bill would broaden the class of beneficiaries who may recover damages in survival actions for wrongful death from statutorily defined “distributees” to “surviving close family members,” as determined by a jury. Compensable damages would no longer be limited to pecuniary losses and instead would include compensation for the following: grief or anguish caused by the decedent’s death; disorders caused by such grief or anguish; loss of love, society, protection, comfort, companionship and consortium; as well as funeral and medical expenses; loss of nurture, guidance, counsel, advice, training and education and pecuniary injuries.

Additionally, the bill would extend the statute of limitations for wrongful death actions from two years to three years and six months and for September 11 victims, the statute of limitations would be extended to four years. The bill would be effective immediately and would apply to any actions pending as of the effective date or commenced thereafter.

The Governor attempted to negotiate a chapter amendment to the bill to address her concerns, such as its impact on malpractice insurance premiums and the cost impact on hospitals, by exempting medical malpractice claims. The Governor published an Op-Ed where she said some version of the bill was necessary while explaining her concerns regarding its impact and urging the Legislature to agree to her proposed changes.

The Legislative sponsors responded via press release by deriding her characterization of a fair proposal to amend by saying “[t]he Governor now says she put forward a ‘fair proposal’ over a month ago, but she doesn’t explain that her counterproposal to the Grieving Families Act only addresses the wrongful deaths of persons under 18 years, and conspicuously exempts deaths that ‘involve or give rise to any actual or potential claim for medical malpractice of any kind.’ Moreover, the Governor’s proposal doesn’t expand the definition of family, nor does it extend the statute of limitations or apply to pending claims.”

Governor Announces Round XII Awards of the Regional Economic Development Council Initiative

The Governor announced that over $22 million has been awarded to support 21 projects across New York State through Round XII of the Regional Economic Development Council initiative.

Highlights include:

Owens-Brockway Glass Container, Inc. (Central New York)

$2.8Million ESD Grant, $1 Million Excelsior Jobs Tax Credit to rebuild and redesign an aging glass manufacturing furnace, converting it into a new more sustainable furnace, reducing CO2 emissions and enhancing energy efficiency.

Diamond Packaging Holdings, LLC (Finger Lakes)

$500,000 ESD Grant, $1 Million Excelsior Jobs Tax Credit to invest in new equipment and facility renovations.

eVero Corporation (Long Island)

$550,000 Excelsior Jobs Tax Credit for investments in an expansion and the purchase of new equipment.

WMCHealth Cellular Tissue Engineering Laboratory (Mid-Hudson Region)

$700,000 ESD Grant to complete phase II of construction which includes the addition of an Experimental Cell Therapy Facility (ECTF).

MHXCO Foam Company, LLC (Mohawk Valley)

$500,000 ESD Grant to increase manufacturing efficiency and global competitiveness.

City Innovations Collaborative – Life Science Incubator Facility– (New York City)

$4.5 Million ESD Grant to seed, cultivate, and sustain a regional life science ecosystem for NYC.

Turin Highland Lodge (North Country)

$120,000 ESD Grant for a newly constructed six-room lodge that will support winter and summer motorized and non-motorized recreation.

Storflex Holdings, Inc. (Southern Tier)

$2.2 Million ESD Grant, $950,000 Excelsior Jobs Tax Credit for a two-site expansion project in the Town of Erwin and the Village of Riverside.

A full list of awardees can be found here.

The application for ESD Grant funds remains open, and applications are being reviewed on an on-going basis until funds are exhausted. Applicants with strong, shovel-ready projects that align with the state and region’s economic development priorities can apply through the Consolidated Funding Application

Comptroller Calls for State Debt Reform Citing Projected $26 Billion Increase Over Next Five Years

State Comptroller DiNapoli issued a report identifying policy and fiscal weaknesses that have allowed state debt to grow to troubling levels and offers a roadmap for state debt reform to improve debt affordability and protect New York’s fiscal health. According to the report, debt service is projected to consume an increasing share of State Operating Funds spending over the next five years constricting flexibility in the operating budget and leaving fewer resources available for other priorities and programs.

New York has both constitutional and statutory limits on State debt. Under the Constitution, State General Obligation debt must be approved by the voters through a ballot proposal for a single work or purpose. Through the years, however, the constitutional limitation has largely been circumvented through the use of debt issued by State public authorities. Nearly 97 percent of State debt outstanding consists of backdoor borrowing by public authorities.

The State’s statutory debt limit was enacted with the Debt Reform Act of 2000. It imposed caps on State-supported debt – voter-approved General Obligation debt and public authority backdoor borrowings – providing a more comprehensive approach to limiting State debt. This cap on debt outstanding, imposed on only new debt issued after April 1, 2000, was phased in over 11 years and eventually limited debt levels to 4 percent of State personal income. The Act also limited debt service spending to 5 percent of All Funds receipts.

To bypass the debt caps, new forms of state debt were created outside the definitions of the Debt Reform Act, including bonds paid from tobacco settlement receipts and bonds to pay for SUNY dormitory facilities. Other debt has been structured in a way that it does not meet the technical definition for being counted toward the cap.

The Debt Reform Act was significantly eroded by actions included in the SFY 2020-21 and SFY 2021-22 Enacted Budgets. These excluded any state-supported debt issued during those two years from the state’s statutory debt caps, totaling nearly $18 billion. Budget actions also allowed the use of debt for non-capital purposes and permitted up to 50-year maturities for bonds issued for MTA purposes. These actions made the state’s debt limits functionally meaningless.

Combined with debt that was initially excluded from the caps, nearly one-third of state-supported debt ($20 billion) was excluded from the state’s debt limits as of SFY 2021-22. Without these debt exclusions, planned issuances would have breached the state’s statutory debt cap by up to nearly $17 billion by the end of the five-year SFY 2022-23 Capital Plan period.

The Comptroller recommends the following debt reform measures:

- Establish Comprehensive, Binding Debt Limits. Meaningful debt reform needs to be addressed through a binding constitutional amendment to impose limits on all existing and future state debt. The calculation should be based on a rolling 10-year average of personal income growth which will provide enhanced stability and predictability for capital and debt financing plans.

- Provide Accountability to Voters. State debt limits should be subject to voter approval, and all state debt should be required to be issued by the State Comptroller. This would isolate long-term liabilities and their associated costs from the temptations of annual budget-cycle gimmicks and prevent short-sighted solutions for near-term budget relief.

- Establish Responsible and Sustainable Practices. All state debt should be required to be issued with a level or declining debt service structure, be limited to a final maturity of 30 years or less and must begin to be repaid within one year. The use of state debt should be precluded from solely benefiting private enterprise.

- Give Flexibility in Times of Emergency. The constitution’s emergency contingencies should be updated to account for the potential crises of the modern era, while establishing boundaries around such possible uses.

Former State Senator to Run for Dutchess County Executive

Former State Senator Sue Serino announced plans to run for Dutchess County Executive. Serino lost her bid for re-election to the Senate to Michelle Hinchey after redistricting drew the two incumbents into the same district. Serino was first elected in 2014, beating one term Democrat Terry Gipson.

Political Updates

City & State NY’s Weekly Winners and Losers here.

City & State NY’s 50 Over 50 here.

Inside City Hall: One-on-one with Gov. Kathy Hochul.

Gov. Hochul’s ambitious housing plan meets suburban blockade.

Governor Hochul mum on next steps in fight over top judge pick.

NY Post: Tiny percent of NY state employees have sexual harassment training despite Hochul mandate.

Mayor Adams plows ahead with plan to privatize health benefits for 250,000 NYC municipal retirees.

New York’s Board of Elections grows heated over ‘leak’ of stalled Zeldin campaign subpoena.

NY Times: Hochul Could Face Battle With Fellow Democrats Over Corporate Tax Increase.

Hochul has big budget plans, but recession concerns raise doubts.

New York sportsbooks urge lower mobile betting tax rate.

Queens district attorney race heats up after challenger calls for Katz to reject court officers union endorsement.

Coming Up

The Board of Regents will hold their next meeting on February 13 and 14.

The Public Service Commission will hold its next meeting on February 16.

The Assembly will hold a public hearing on the status of mandated reporters of child abuse or maltreatment on February 16.

The Commission on Ethics and Lobbying in Government will hold their next meeting on February 28.